UNDERSTANDING THE STEEL RALLY

UNDERSTANDING THE STEEL RALLY

A sector which has remained in the limelight for the last 12 months, for good reasons, is Indian steel sector. Share prices of the leaders – Steel Authority of India and Tata Steel are up over 250% in the last 12 months. So, let’s understand why.

Driven by the future potential impact of Covid-led pandemic, there was a sense of urgency shown by the policy makers, both in Indian as well as global markets. This was to aggressively target the hindrances to economic recovery. They announced large stimulus packages. While these steps have surely helped economies in buying time to find a sustainable long-term solution to this pandemic-driven downturn, the impact of these measures has resulted into a significant up-turn in global commodity cycle.

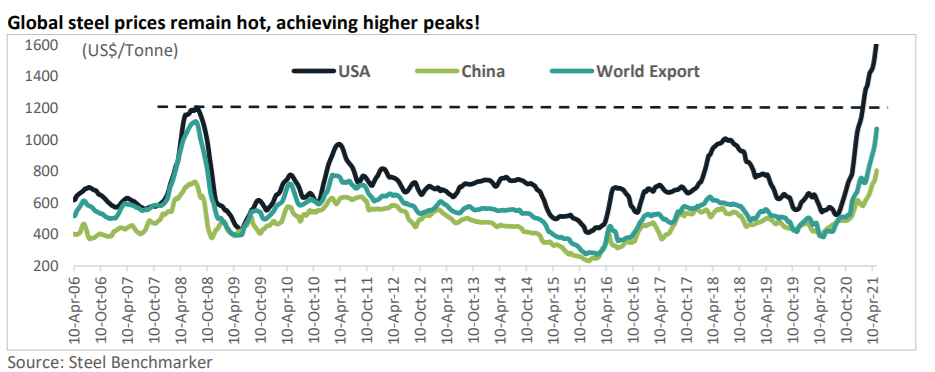

This is the not the first time. A similar trend was seen post 2009 i.e. after the global financial crisis. The difference though this time around was that the world witnessed a much sharper recovery in 2020, when compared with the global financial crisis. No doubt, the policy action was much more judicious and the size of the stimulus much higher in 2020. Global steel prices which witnessed an upswing during the second half of CY20 has continued its momentum in 2021 as well. The rally has not only achieved new peaks (surpassing the decadal-high prices witnessed during 2009) but has also shown strong resilience in terms of decline from the peaks. Global steel prices kept inching up, largely driven by demand-supply mismatch, which was a result of a sharp re-bound in demand, while the steel mills were not only late to anticipate the sudden spike in demand, but also grappled with the supply side logistics in sourcing of key raw materials. This apart, supply shortage for sea-borne iron ore also resulted into global iron ore prices surging up, breaching the historically higher peaks.

Let us understand the role of China.

As always, China continues to remain the focus point when it comes to a commodity rally. Covid-19 virus originated from China. This was followed by a quick response from the Chinese government in the form of a giant package to help curtail the impact on the economy. The outcome of the stimulus resulted into significant growth in Chinese steel demand, which according to the World Steel Association grew by around 9% in 2020 (in a pandemic year!), whereas the production increase was around 5%. What has really helped the global steel prices is the declining gap between Chinese production and consumption, which reduced the exportable surplus to around 30 million tonnes in 2020, as compared with 100 mn tonnes during 2015. Moreover, China remained a net importer of steel for a few months in the second half of 2020. This is a scenario not seen in the past decade or so, which triggered the upside in global steel prices. China now accounts for a global share of more than 55% in both steel production & consumption.

Let’s look at the domestic markets.

As anticipated, domestic demand for steel was impacted by slowdown in manufacturing activities during 2020. Owing to the slowdown in domestic demand, Indian steel players resorted to higher exports volumes, which resulted into India becoming a net exporter of steel during in 2020 as compared with being a net importer of steel during 2019. Steel production also took a substantial hit in the first half of 2020. As the lockdown measures were eased, domestic demand started picking up, being an essential activity, production for steel also started increasing. By August 2020, the Indian steel industry was able to reach the pre-covid levels of about 9 million tonnes of monthly production. This time though, apart from a gradual recovery in domestic demand, steelmakers were positively surprised with the opening of the export window, which provided the much-required support in improving their sales volumes.

Road Ahead.

Overall, economists believe that global steel demand will be 6% higher in 2021 and 3% in 2022. Domestically, demand is expected to grow at 7-8% during the next 2-3 years. While the demand for flat products in the domestic market is likely to be supported by the pipe manufacturing, roofing and the automobile sectors, demand for long products will continue to increase largely on the back of the infrastructure spend. The government-targeted infrastructure spend is likely to be the key factor which should be monitored very closely when it comes to domestic steel demand outlook. As one can expect, focus on infrastructure and government initiatives such as ‘Make in India’ should boost steel demand growth. In addition, the number of planned initiatives such as building smart cities, affordable housing, dedicated freight and high-speed rail corridors should continue to provide resilient demand growth. While the demand has been on an improving trend, economists remain cautious in terms of the likely impact of the second and third wave of the pandemic. Although probabilities of a complete lockdown are gradually fading away, any kind of partial lockdowns/restrictions does have its impact on the manufacturing and infrastructure building activity.

Related Posts

SPECIALTY CHEMICALS MARKET IN INDIA

SEP 27, 2021 - IN INDUSTRY ANALYSIS

Global Specialty Chemicals market size is pegged at ~$805 bn and is expected to reach $1.2 tn by 2025 (a 6.4% CAGR). Globally, ~25% of the total specialty chemicals production is exported, totaling to ~$200 bn.

E-GROCERY IN INDIA

JUL 26, 2021 IN INDUSTRY ANALYSIS

Over the last decade, the Indian food and grocery market has been growing at over 10+% year over year driven by GDP growth, population growth, growth in average disposable income etc. However, the most critical factor for such a growth is the integration of technology. As per various estimates, the online grocery market has grown at 25x to 30x and reached the $3 billion mark. Nationwide lockdowns have added the fuel to the growth with surge in app visits & daily orders of e-Grocers.

INDIAN EQUITIES

JUL 29, 2021 IN EQUITY MARKET

When it comes to Indian equity markets, our eyes focus on two benchmark indices. With Nifty 50 Index around 15,700 and BSE Sensex around 52,000, there was another milestone, which we hit – that is linked to market capitalization.